How Localization and E-sports Stats Fuel Gulf Gaming Investments

Gaming is increasingly competing for people’s leisure time. Globally, there are around 3.09 billion active video gamers. Each of them contributes to the growth of E-sports and gaming industry and increases the need for games localization. Will 2024 live up to our expectations of being an interesting year? Will the gaming industry keep developing into a social pastime that brings people from all over the world together?

The gaming or E-sports industry is one of the fast-moving industries. It has been growing rapidly and has a great impact on the number of game creators and investors, not to mention the end users and some regions like the Gulf gaming sector and its games localization specialists.

Let’s dig deep and look at e-sports statistics, as it will give us a great look at its future worldwide and in some regions that show great growth potential.

The Number of Video Gamers in 2023, What Is It Showing Us and Why Is It Important for Gaming Investors to Be Aware of?

In 2023, approximately 3.26 billion individuals worldwide, accounting for about 41% of the global population, were actively involved in the realm of video gaming. This remarkable figure not only showcases the immense popularity of the industry but also demonstrates its remarkable ability to bridge gaps across geographical and cultural divides.

These E-sports statistics show that among internet users worldwide, approximately 81.9% participate in gaming activities, indicating that nearly eight out of every ten individuals who use the internet are gamers. Notably, the top five countries with the highest gaming participation rates include the Philippines (95.8%), Indonesia (94.8%), Vietnam (93.1%), Thailand (93.0%), and Turkey (92.3%).

Younger demographics, particularly individuals aged 18-24, exhibit a higher propensity for making purchases related to video games compared to older age groups. Men display over three times the likelihood of engaging in gaming-related purchases compared to women. Individuals holding high school diplomas or associate degrees demonstrate the highest likelihood of engaging in gaming-related purchases, while those in dentistry exhibit the lowest likelihood. Individuals earning above $90,000 are less inclined to make gaming-related purchases compared to those with lower incomes. There is a decreasing likelihood of video game purchases as the duration since the completion of one’s highest degree program increases.

Pwc report media report had mentioned some of the E-sports statistics and projected growth trajectory of total gaming revenue indicates a substantial increase from US$227 billion in 2023 to an estimated US$312 billion by 2027, marking a notable compound annual growth rate (CAGR) of 7.9%. This surge underscores the growing confidence in the gaming sector. Moreover, advertising revenue within the industry is anticipated to witness significant growth, nearly doubling from its 2022 figures and reaching a milestone of US$100 billion by 2025.

These E-sports statistics are a great indicator for investors in the gaming sector. Given its extensive global player community and substantial growth prospects for both development and profitability, mobile gaming is anticipated to attract significant investment. Businesses are advised to leverage this trend by creating distinctive mobile game titles, introducing innovative player engagement approaches, and allocating resources to mobile gaming platforms. Notably, in the United Arab Emirates, the average daily time spent by mobile gamers engaging in video games ranges from 20 to 40 minutes, according to Statistica.

Also, E-sports statistics show us a lot about regions, demographics of gamers in these regions. Niko’s report says about the MENA and Africa’s game industry that:

▪️ In 2023, the video game market in the MENA-3 region amassed a total revenue of $1.92 billion, marking a 7.8% year-over-year increase, with projections indicating a climb to $2.65 billion by 2027, boasting a 5-year compound annual growth rate (CAGR) of 8.2%. Notably, all three countries under observation experienced growth in their respective games markets during 2023.

▪️ The total number of gamers in the MENA-3 region reached 68.4 million in 2023, reflecting a 2.9% year-over-year rise, with forecasts anticipating an increase to 79.6 million by 2027, boasting a 5-year CAGR of 3.7%.

▪️ A significant proportion, accounting for 71.5% of gamers in the MENA-3 region, actively engage with E-sports activities, including watching E-sports content, participating in E-sports games, or competing in amateur or professional tournaments. Notably, government backing for E-sports initiatives stands out as a prominent driver of growth within the region.

▪️ Saudi Arabia (KSA) emerges as the largest market by games revenue in the MENA-3 region and holds the position of gaming powerhouse within the region, contributing more than half of the regional revenue in 2023.

▪️ Smartphones serve as the primary gaming device for the majority of gamers in MENA-3, with 87.2% of gamers utilizing them, and they also record the highest average hours of gameplay each week, averaging 8.7 hours.

▪️ The top three most played intellectual properties (IPs) in the MENA-3 region—PUBG, EA Sports FC, and Call of Duty—are embraced by two-thirds of all gamers, based on insights derived from Niko’s survey findings.

The gaming industry is now a rising star and it’s evident now that the gaming industry isn’t solely about entertainment; it’s a substantial business endeavor. Despite all these great sports statistics, all investors need to look at the KPIs, financial and non-financial indicators such as:

🔰Average revenue per user (ARPU): It calculates your total revenue divided by the number of users within a specific timeframe. This metric provides insight into the average revenue generated from each user, aiding in the identification of the most successful channels for your business.

🔰 Average revenue per paying user (ARPPU): It is a metric utilized by game marketers to determine the average revenue generated by paying users and players within a defined time frame.

🔰 Game Retention rate: indicates the proportion of users who download your app and subsequently revisit it for usage, calculated from the specific day of download.

🔰 Game LTV: LTV, or Lifetime Value denotes the total revenue generated or anticipated to be generated by a player throughout their duration of engagement with a game. A higher LTV indicates greater profitability for the game from that player.

🔰 Churn Rate: The churn rate represents the portion of players who cease playing a game within a specified timeframe. For social games, the typical monthly churn rate falls between 1% and 2%. In practical terms, this suggests that approximately 1 out of every 100 players will discontinue playing the game after completing one session.

🔰 Conversion Rate: this is a crucial metric for evaluating your capacity to transition free users into paying customers, which is of significant interest to investors. A high conversion rate is inherently advantageous. This metric quantifies the number of users who have completed a purchase within a designated time frame.

Gulf E-sports Statistics for 2024, What Does Make the Gulf Gamers Different than Worldwide Gamers? Why is Games Localization to Communicate with Gamers in the Region?

UAE E-sports and Saudi E-sports sectors are two of the main players in the industry in the MENA region and are leading it by $6bn investment. Under the title “Future of Trade 2023 Gaming in the MENA: Geared for Growth” DMCC has published a report that revealed lots of details about the MENA gaming sector, highlighting the efforts of Saudi and Emaritti governments in the industry and how both are on the track to create a new future for the industry.

The huge number of gamers in the MENA and Gulf is essential to look at and analyze it to find out the needs of this huge market (projected to be 87.3 million in 202make gaming investors and gaming companies think of games localization to connect with this huge audience and to build a strong connection with them game localization companies. The role of game localization companies when communicating with Arab gamers is not to mess; As their game localization services is a bridge between different cultures and people who don’t speak the same language.

Gulf Audience has its own characteristics that differentiate them from other gamers in global regions. They Speak Arabic that requires Arabic games localization to make games easier to be played. They have their own customers that need to be respected and considered when communicating with them.

By the end of 2023 Saudi Arabia and UAE have launched to mega programs that will put game localization services on the top of needed services.

Gulf Main Gaming Projects and Trends, Would Games localization Services Help in The Gulf Gaming Sector Expansion?

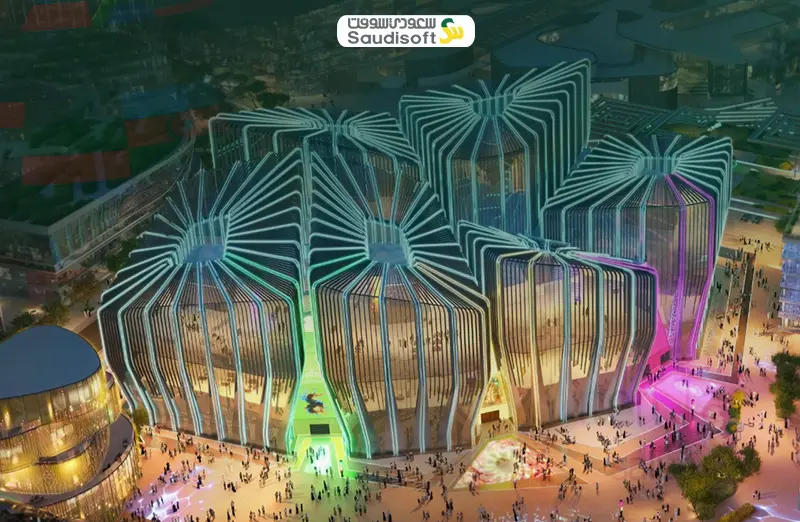

Saudi Arabia E-sports District in Qiddiya

Saudi Arabia E-sports District in Qiddiya

Saudi Arabia has unveiled proposals for the establishment of a dedicated gaming and e-sports district within Qiddiya, a sprawling mega-city envisioned as an epicenter of entertainment. Spanning an expansive 500,000 square meters of land, the gaming district aims to accommodate as many as 25 e-sports teams concurrently. This initiative is strategically positioned to harness the burgeoning momentum of the online gaming industry, forecasted to experience an annual growth rate of 5.47 percent. By 2028, the sector is anticipated to attain a market volume totaling US $34.11 billion. Saudi Arabia’s first language is Arabic, and its citizens speak Arabic and prefer communicating in Arabic.

The Qiddiya project forms an integral component of Saudi Vision 2030, a comprehensive initiative designed to bolster and broaden the economic landscape of Saudi Arabia. Its overarching goal is to diminish the nation’s dependence on oil revenues while fostering economic diversification. Moreover, the project endeavors to generate numerous employment prospects, particularly targeting the youth demographic, thereby contributing to overall socio-economic advancement.

Arabic games localization is essential step before entering the Saudi gaming market as games localization makes the game more usable by the audience through translation and localization.

Dubai Program for Gaming 2033

The gaming scene in Dubai is on the brink of a notable shift, offering a special chance for evolution and adaptation in response to evolving trends. It’s vital for those involved in the industry and experts alike to recognize this shift and evaluate its potential influence on the sector at large. With the Dubai Program for Gaming 2033 poised to make significant waves, it’s imperative that we closely monitor its development and anticipate the fundamental changes it could bring to the gaming landscape.

Dubai’s Vision 2030 seeks to broaden the emirate’s economic horizons through a focus on innovation and technological advancement. Within this vision, the gaming industry stands out as a primary target sector. Embracing gaming not only allows Dubai to tap into a flourishing industry but also paves the way for inventive marketing strategies, fresh business opportunities, and captivating content creation tailored to a worldwide audience deeply immersed in gaming culture. Additionally, Dubai Program for Gaming 2033 strives to substantially elevate the games and E-sports sector’s role in fueling the expansion of Dubai’s digital economy, with the objective of augmenting the GDP by an estimated US$1 billion by the year 2033.

Sheikh Hamdan further stated, “Through the launch of ‘Dubai Program for Gaming 2033,’ our objective is to establish an incubating environment for developers and to draw leading technology companies from across the globe, particularly those specializing in digital content and experiences. The program will offer support to developers, designers, programmers, as well as entrepreneurs and startups in the creative industries.”

The program has 3 different area of focus:

▪️ Talent: the program aims to help new talents to get into the gaming industry by creating new opportunities in development, games localization, marketing etc. This initiative endeavors to create a platform geared towards enhancing the technological skills of 1,000 talented Emiratis.

▪️ Content: The program delves into comprehensive content that explores the concept of the Metaverse, its various applications, and potential uses.

▪️ Technology: This initiative will play a vital role in bolstering Dubai’s mobile application market, especially with the backing of various government entities and through collaboration with leading global technology firms and software localization agencies.

Games localization in the Era of Gulf Gaming Technologies Revolution

Games localization can help you own the gaming industry in MENA and Gulf. Focusing on Arabic game localization is paramount. When attracting players from the MENA region, providing them with a fully immersive experience through game localization services is key. Localizing games into Arabic significantly contributes to the success of international games in the MENA market.

For years, Saudisoft team has collaborated with leading game companies, assisting them in accessing gaming markets worldwide. We specialize in providing video game localization services to developers and publishers, serving as the bridge to the global gaming industry.

We can guide you to your next significant audience in the Gulf region. Contact us.